Not many financial concepts can be described as risk, considering that most financial counselors strongly understand their significance. The accuracy and actual execution of the findings varies amongst customers, even though advisers frequently employ surveys or quantitative instruments to gauge a customer's risk-bearing level and fulfill regulatory criteria.

What Are We Attempting to Measure?

The degree to which a customer is willing to take the possibility of a less satisfactory result increases the likelihood of a more favorable outcome.

To be more precise, the company believes that risk tolerance is a psychological feature influenced by both genes and upbringing. Instead of just asking a series of open-ended questions, accurate risk assessment requires the evaluation of clients' capacity for risk of different aspects of the situation.

In addition, there are several factors to think about:

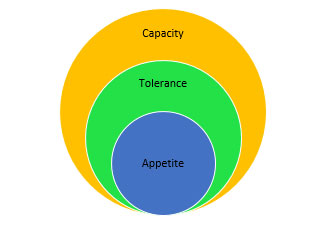

- Risk Tolerance: It is the amount of uncertainty that a customer is prepared to accept in exchange for higher potential profits.

- Risk Capacity: The amount of risk a customer can bear to incur without putting their goals in danger is their risk capacity.

- Required Risk: It is an indicator to evaluate how much danger must be accepted to achieve a customer's goals.

Advisors need to think about what may happen if such different kinds of risks are misaligned. If a customer has a high-risk expectation but a low-risk exposure, for example, the adviser may need to adjust the customer's payout ratio downward. If a financial adviser focused solely on the Client's Risk Assessment while constructing a portfolio, the customer would probably be dissatisfied with the results.

Tools Provided by Independent Third Parties

When providing advice on portfolio construction, there aren't as such dictating laws or regulations about the precise client's risk assessment method. There are a variety of risk tolerance surveys that financial advisers may use to determine how much volatility their clients can handle.

Many customers misinterpret their risk tolerance, either because they haven't experienced a recession or because they don't grasp the yield effect of risk avoidance, even if they've gone through a recent downturn. It may also be challenging for clients who aren't acquainted with economic terms to convey their worries and the level of risk they're willing to take to their adviser.

Surveys are inherently wrong, but financial advisers may do better using objective, third-party data-based solutions. Such tools help make portfolio return projections risk-based and include statistics meant to evaluate the predictions. Clients may get a better sense of how risk impacts their portfolios with the aid of these instruments rather than depending on the assumptions of a survey.

Potential Drawbacks and Risk Tolerance Survey

The ability of a customer to absorb financial setbacks is the primary factor in determining their risk tolerance. Historically, this approach has been subjective, with the customer rating their level of comfort with risk ranging from "low" to "extreme."

Suggestions based simply on the customer's emotions and the use of a contextual measure in and of themselves lead to strategies that are not in sync with the customers' requirements.

Subjectivity and Biasness

One major drawback of the conventional risk tolerance assessment is that it is highly subjective. These biases might be a product of one's upbringing or the result of the present climate. It's very uncommon for investors to panic in a market downturn, which can harm their ability to achieve their savings objectives over the long run.

Furthermore, customers' reactions might vary considerably on a daily basis on various factors, including their level of trust in you, the adviser, and their troubles. Considering the typical client lacks investing expertise, it is unfair to expect them to make a subjective and biased financial evaluation.

Failure to Provide Quantification

Another major flaw of electronic risk tolerance surveys is that it's impossible to assess the subjective components of risk tolerance precisely because it depicts an intangible psychological attribute in the initial situation.

Looking at the classic conservative, intermediate, and strong scales, we notice an absence of concrete numbers. Despite the fact that they have meaning, these terms cannot be precisely measured since they are subjective and exist on a scale that is not objective.

These terms are not just open to client prejudice but also to the attorney's or company's subjective interpretation. What one adviser or company may consider "risky," others might consider "balanced" or "conservative."

Results Application

Implementing these results for customers requires financial advisers to avoid prejudice and adequately set customer requirements.

Many advisers are willing to take on more risk than their customers because they have a better grasp of data and the economy. In addition, research suggests that financial advisers construct portfolios collectively with a higher degree of risk than their customers are comfortable with. In the case of a market decline, the customer may not be prepared to see their investments take such a significant decrease in value. However, these characteristics might be risky.

The correct assumptions should also be set from the beginning by financial experts. Even if it is simpler to demonstrate hypothetical portfolios using modern risk analysis technologies, advisors should warn clients of the markets' long-term characteristics and the possibility of short-term instability. Clients must know that higher risk tolerance equals a more substantial chance for loss, while a lower risk threshold equals a lower possible return on investment.

Conclusion

There are few economic concepts as unspecified as "risk," which comprises three components: risk-bearing level, risk capacity, and risk requirement. Financial advisers are aware of the significance of the risk. Financial advisers and their customers can benefit from using independent, objective tools to understand each other's risk profiles better. Finally, advisers should cautiously put this counsel into action without factoring in their prejudices.